- There are no such fan pages of these banks as they are just financial institutions and no one really follows fan pages of such institutions. But this is a bunch of information I found online while I was searching about these banks.

- This was the outcome of a survey done by BMO bank of the number of their clients who do mobile banking on a regular basis. Quebec has the highest number at 75% and Alberta and British Columbia has the lowest at 64%. Among that, 74% are men and 67% are women.

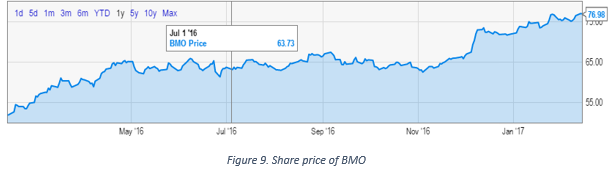

- This is a chart stating the prices of the share prices of BMO over the last 10 months. In last April it was less than $52 and now it is at $76.98.

- This chart shows the share price of National Bank. In march2016, it was at $28. In February 2017 it is a little more than $44.

- BMO’s shares have gone up at a faster pace than National Banks. This is because BMO is a much older bank than National bank and has a better hold in the share market. If it goes down, it doesn’t take much for BMO to get back up again. Whereas if National Banks share go down, they have to struggle to get them back up again.

I personally think that BMO is a

better option for people since it offers better interest rates, better mortgages

and better loan options (as I saw when I searched about the banks).

No comments:

Post a Comment